The borrower is Danube Solar Five, a special-purpose vehicle incorporated in Romania, owned by Lithuania's INVL Renewable Energy Fund I and ultimately managed by UAB INVL Asset Management (INVL). INVL has operated for more than three decades and has more than €1 billion of assets under management, including real estate, energy, and infrastructure across the Baltics and Eastern Europe.

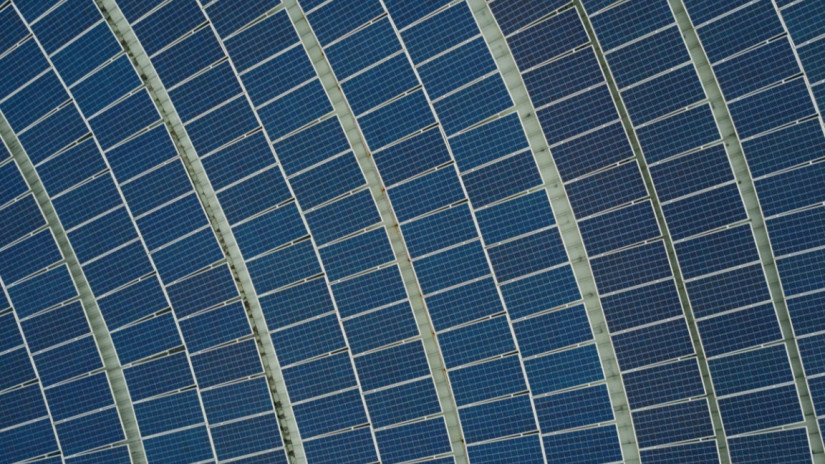

The Bank's finance amounts to half of a €24.4 million bond to build the plants at Robanesti and Pielesti, which will have a total installed capacity of 60MW. Co-lender Eiffel Investment Group, a Paris-based energy infrastructure investment fund and existing partner of the EBRD, will provide the remaining €12.2 million.

Eiffel Investment Group is an asset manager with €6.4 billion under management. Backed by the Impala group founded by entrepreneur Jacques Veyrat, the Eiffel Investment Group cultivates strong industrial expertise, particularly in the field of the energy transition, but also the life sciences, agri-food, and digital sectors. Eiffel Investment Group invests in a sustainable world. Its investment strategies aim to generate not only a strong financial performance but also positive social and environmental impacts. Eiffel Investment Group's team counts around 100 talented professionals, in France (Paris), BeNeLux (Amsterdam), the United States of America (New York), and the UAE (Abu Dhabi).

As a member of the European Union (EU), Romania is committed to implementing the EU's Fourth Energy Package, “Clean Energy for all Europeans”. This aims to modernize the EU electricity market, making it more flexible and better able to integrate a greater share of renewables. Romania has recently significantly improved the domestic regulatory environment for renewables, starting with the full liberalization of the local energy market from 1 January 2021.

Romania's growing ambition in this area builds on EU-wide commitments enacted in the Fit for 55 and REPowerEU plan to increase renewables production by 2030. In 2023, Romania committed to increasing the share of renewables in its total energy consumption from 24.3 percent in 2019 to a more ambitious 36.2 percent by 2030, by adding 11.9 GW of new renewable capacity.

To date, most investments in the region have been made by independent power producers which typically own projects throughout their life cycle. Although institutional investors also have an appetite to own these assets, they are often limited in their capacity to shoulder initial construction and development risks. Limited recourse construction bridge facilities (CBFs) are innovative financing structures that allow developers to bridge this risk.

CBFs are expected to play a key role in unlocking additional capital inflows into the renewables sector, which needs large-scale investment to meet the region's ambitious green transition target.

“While CBFs are now common practice in Western Europe, only one construction bridge facility has been financed in Romania to date. The EBRD's involvement in the segment provides the market demonstration effects for other potential financiers in the country to follow suit,” said Grzegorz Zielinski, EBRD Head of Energy Europe.